Este artículo también está disponible en español.

Bitcoin price is recovering higher above the $95,000 level. BTC is showing positive signs and aims for a fresh increase above the $98,000 level.

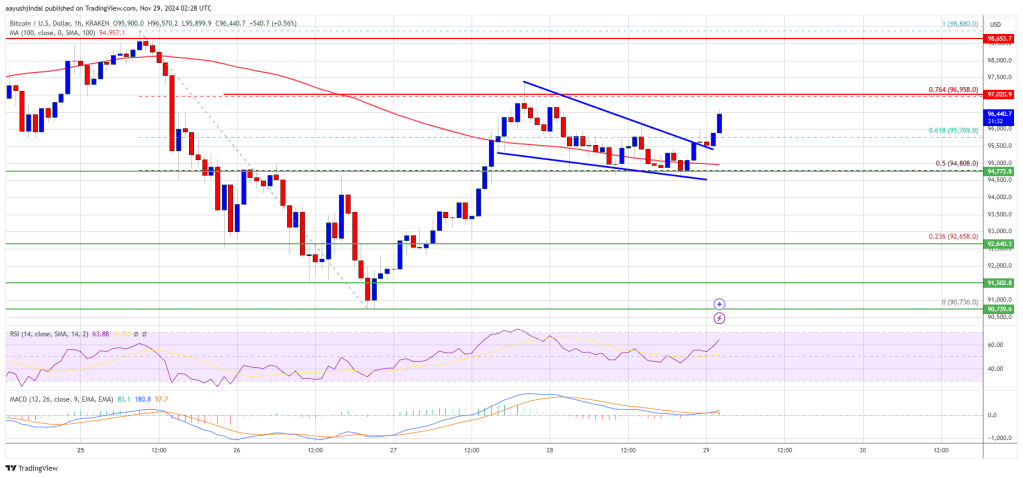

- Bitcoin started a fresh increase above the $95,000 zone.

- The price is trading above $95,500 and the 100 hourly Simple moving average.

- There was a break above a short-term contracting triangle with resistance at $95,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could gain bullish momentum if it clears the $97,000 resistance zone.

Bitcoin Price Eyes More Upsides

Bitcoin price remained stable above the $93,500 zone. BTC formed a base and started a fresh increase above the $94,500 resistance zone. The bulls were able to push the price above the $95,500 resistance zone.

There was a break above a short-term contracting triangle with resistance at $95,500 on the hourly chart of the BTC/USD pair. The pair climbed above the 61.8% Fib retracement level of the downward wave from the $98,880 swing high to the $90,735 low.

Bitcoin price is now trading above $95,500 and the 100 hourly Simple moving average. On the upside, the price could face resistance near the $97,000 level. It is near the 76.4% Fib retracement level of the downward wave from the $98,880 swing high to the $90,735 low.

The first key resistance is near the $98,500 level. A clear move above the $98,500 resistance might send the price higher. The next key resistance could be $98,800. A close above the $98,800 resistance might initiate more gains. In the stated case, the price could rise and test the $100,000 resistance level. Any more gains might send the price toward the $102,000 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $97,000 resistance zone, it could start another downside correction. Immediate support on the downside is near the $95,500 level.

The first major support is near the $94,500 level. The next support is now near the $93,200 zone. Any more losses might send the price toward the $91,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $95,500, followed by $94,500.

Major Resistance Levels – $97,000, and $98,800.

Cardano

Cardano Founder Reveals What Will Onboard 3 Billion New Users Into Crypto

Solana

Solana Compresses Near Previous ATH – Gearing Up For The Next Leg Higher?

Ripple

XRP Transactions Fall, But Active Wallets And DeFi Liquidity Tell A Different Story

Litecoin

Litecoin Looks Poised To Explode As Grayscale Buys 10,000 LTC

Dogecoin

Dogecoin Pulls Back To ‘The Golden Ratio’ – Analyst Expects A Bullish Reversal

Dogecoin

Dogecoin Adam & Eve Structure Hints At Bullish Potential – Can DOGE Breakout?

Litecoin

Analyst Says Litecoin Will Outperform Bitcoin And Large Cap Cryptos With 11,000% Breakout

Dogecoin

Dogecoin $10 Price Target Back In Play? Here’s What The Charts Say